- Joint TT Club & McKinsey report concludes that the future is digital

- ‘Brave new world?’ examines two potential future digital scenarios, one of which is termed ‘Digital reinvention’

Industry experts, looking at the future for the container transport industry over the next 25 years, see the possibility of traditional supply chain service providers being significantly challenged. Increasingly digitally enabled services, which can directly control the flow of goods from factory to consumer, will become progressively more influential.

Indeed, these ‘Digital natives’, that apply technology to previously unsolvable challenges (as has been seen with Amazon and Alibaba), as well as ‘scrappy tech start ups’, fast-moving newcomers assuming an integrator role, could transform and re-shape the container transport industry.

In their ‘Brave new world? – Container transport in 2043’ report, leading international freight transport insurer TT Club, in conjunction with global management consulting firm McKinsey, have looked at the future of containerised trade, how value can be created and who the ‘winners’ could be within the industry by 2043.

Having carefully garnered the perceptions of leading figures from a cross section of the transport industry and beyond, the report highlights that an efficient containerised supply chain, acting like a conveyor belt from factory to consumer, could be one of the significant changes in the future outlook.

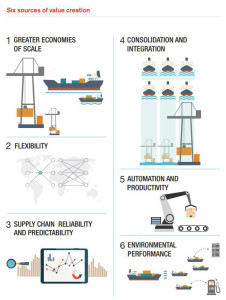

It acknowledges the well-known paradox of cargo owners and end-consumers enjoying lower costs, while industry players struggle to share in the value-creation and highlights six potential sources of value creation.

1. Greater economies of scale – The exceptional expansion in ship sizes has reverberated through the rest of the container supply chain. A key question for the future is the extent to which customers prefer lower unit costs or greater flexibility

2. Flexibility – Do customers value faster, more direct services? If so, scale would be deprioritised in favour of flexibility and modularity

3. Supply chain reliability and predictability – The other side of the flexibility coin, as e-commerce changes consumer expectations, driving improved cycle-times and transparency

4. Consolidation and integration – So far seen in limited segments of the industry, which is still fragmented compared to some comparable industries and with potential of optimisation through vertical integration

5. Automation and productivity hold the potential to improve reliability and service levels, while reducing structural cost#

6. Environmental performance – Responding to the challenges relating to fuel and emissions but also the growing societal sensitivities towards protection of the environment

The container transport industry today is entering a period of incredible experimentation as different players try to find a winning formula to create value. The Digital Reinvention scenario goes some way to utilising the six suggested sources of such value creation, resulting in a 2043 landscape in which the incumbents of the container transport industry lead what is fundamentally a digital future, where trade developments may not be the key driver. In this world, flexibility, resilience and optimisation are paramount, applying the ‘last mile’ lessons to deep sea trades. Furthermore, vertical integration becomes the strategic imperative in order to build effective digital platforms and operating systems that both satisfy, and benefit from, end to end demand. Scale economies lose value, as flexibility and deep integration into customer supply chains increase, providing transparency, predictive capability and high reliability.

In this 2043 scenario, as the report states, “Digital, data and analytics have indeed become the fundamental driver of value creation. Players with significant asset footprints lead the way, with proprietary data that allows them to out-compete any potential disruptive entrant. Data and technologies like blockchain are used in creative ways and many digital native suppliers of software and analytical solutions thrive.”

Charles Fenton, TT Club’s CEO highlights the thought-provoking nature of the research:

“The container transport industry faces a complex future. The industry experts in this research are generally agreed that the physical characteristics of the industry won’t change radically. However, automation holds enormous potential; digital, data and analytics will be central to competitive dynamics, and the business models of industry leaders in 2043 could look very different from today. Digital reinvention is just one of four potential scenarios that our report envisages. Its in-depth challenge to our perceptions of the future is well worth close consideration. ”

To download a copy of ‘Brave New World?’ please visit: https://www.ttclub.com/news-events/brave-new-world/

ENDS

About TT Club

TT Club is the international transport and logistics industry’s leading provider of insurance and related risk management services. Established in 1968, the Club’s membership comprises ship operators, ports and terminals, road, rail and airfreight operators, logistics companies and container lessors. As a mutual insurer, the Club exists to provide its policyholders with benefits, which include specialist underwriting expertise, a world-wide office network providing claims management services, and first class risk management and loss prevention advice.

TT Club is managed by Thomas Miller.