Global container shipping turned a corner in the second quarter of 2022 according to the findings of the latest Quarterly Review of the market produced by MDS Transmodal and Global Shippers Forum.

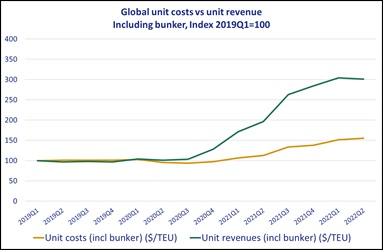

Covid lockdowns in China, suppressing supply of manufactured goods and demand for raw materials, and plummeting sentiment in consuming countries, due to rising interest rates and energy prices, contributed to a fall in average earnings per container carried for the first time since 2020. (Graph 4.1)*

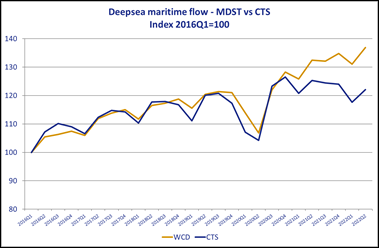

While total container carryings were up on Q1, this volume remained below the level recorded in the same period a year ago (Graph 1.2). This was despite traffic that had switched to other modes or to bulk shipping earlier in the year returning to the more traditional containerised mode.

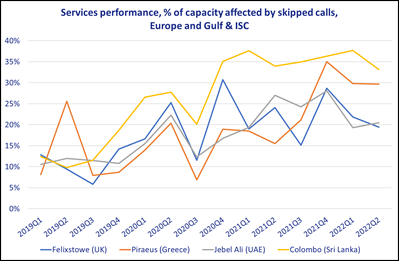

The reliability and consistency of port calls showed a small improvement in Q2, but this was seemingly made by intermediate port calls being missed altogether. The capacity lost to ‘skipped’ ports remains high (Graph 7.2).

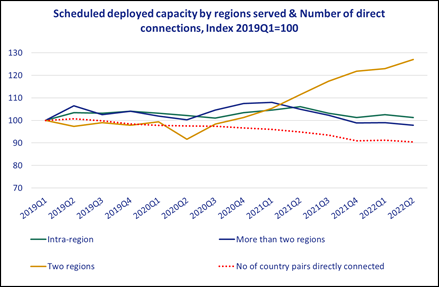

A reshaping of container shipping service patterns seems to be underway with a further increase in Q2 of the number of services connecting no more than two regions, together with a reduction in those linking more than two regions (Graph 2.2). In practical terms this means long, multi-port ‘loop’ schedules are being replaced by ‘shuttle’ services with transhipments required at hub ports in order for containers to reach their ultimate destinations.

Mike Garratt, Chairman of MDS Transmodal commented, “In the last quarter we have seen global network capacity grow marginally but underlying demand stay flat. Spot freight rates are now falling steadily and it will be interesting to see as a consequence the share of the minor bulks trade that returns to the major lines. The direct connectivity and reliability of making port calls offered to shippers continues to deteriorate.

In welcoming the Quarterly report James Hookham, Director of GSF, said, “This is the first time the GSF/MDS Transmodal Quarterly Review is showing a significant change in the direction of travel. This is just one set of data points, but shippers are telling us the world economy, international trade and the global shipping market have entered a new phase, with different factors at work compared to the past two years.”

Over the coming months, GSF and MDS Transmodal will continue monitoring whether the opportunistic gains made by shipping lines since 2020 are consolidated into a strategic shift in rates and service patterns imposed on shippers, or whether different carriers will respond instinctively and distinctively to the changing conditions.

James Hookham continued, “This change in market dynamics could provide a context for the use of freedoms granted to shipping lines under anti-trust immunity and Block Exemption legislation to re-engineer an industry-wide shift in capacity deployment, service patterns, port call frequency and market share concentration. Recent experience has shown this is not a market where regulators can ‘legislate and forget’ hoping expected behaviours are observed.

The number of parameters needed to monitor the market are many and complex and GSF and MDS Transmodal invite competition regulators around the world to ‘watch this space’ with us over the coming months”.

*Note: The Graph numbering refers to that employed in the Quarterly Review the full text of which is available on request as detailed below.

- The Container Shipping Market Quarterly Review is produced every three months and reports, interprets and comments on trends and developments in the container shipping market as experienced and understood by shippers – the importers and exporting businesses that own the cargo carried on container ships. Shippers are the customers of the container shipping industry.

- The Quarterly Review collates and reports outputs from MDS Transmodal’s established and respected Container Business Model and other tools that are relied upon by governments and international agencies around the world. Working with GSF, MDST has generated eight new indicators showing how the market is performing in terms that are relevant and applicable to shippers as users and customers of these services.

- MDS Transmodal (MDST, www.mdst.co.uk) is a UK firm of transport economists which specialises in maritime and all other modes of freight transport. MDST works with senior management in the public and private sectors to provide strategic advice based on quantitative analysis, modelling and sectoral expertise.

- Global Shippers Forum (www.globalshippersforum.com) is the global business organisation speaking up for exporters and importers as cargo owners in international supply chains and trade procedures. Its members are national and regional shippers’ associations representing hundreds of manufacturing, wholesaling, and retailing businesses in over 20 countries across five continents. GSF works for safe, competitively efficient, and environmentally sustainable global trade and logistics.