As global trade declined during the second half of 2022, in response to severe economic headwinds in many countries and the continued effects of the Covid-129 pandemic, the GSF/MDS Transmodal Container Shipping Market Review reflected the impacts on the activity and fortunes of shippers of unitised goods in international trade.

The latest edition of the Container Shipping Market Quarterly Review published today, reports data from the third quarter of year – a time of marked increases in consumer and producer price inflation, historically large increases in interest rates by central banks and high levels of stock inventories in many importing countries. Global energy prices edged higher amid disruptions to supplies arising from the Russian invasion of Ukraine.

However, the impacts of widespread ‘lock-downs’ and stay-at-home orders in China to contain the spread of Covid-19 do not appear to have significantly affected export volumes according to its national trade statistics.

Key highlights of the Review include:

- Trade volumes of goods capable of being transported in containers continued the decline observed at the end of Quarter 2, but the drop in overall volumes was much less than that reported by the container shipping sector. This is attributed to commodities, such as coffee, scrap metal and plywood, that can also be carried in bulk or semi-bulk form, switching away from containerised movements where shipping rates remain relatively high.

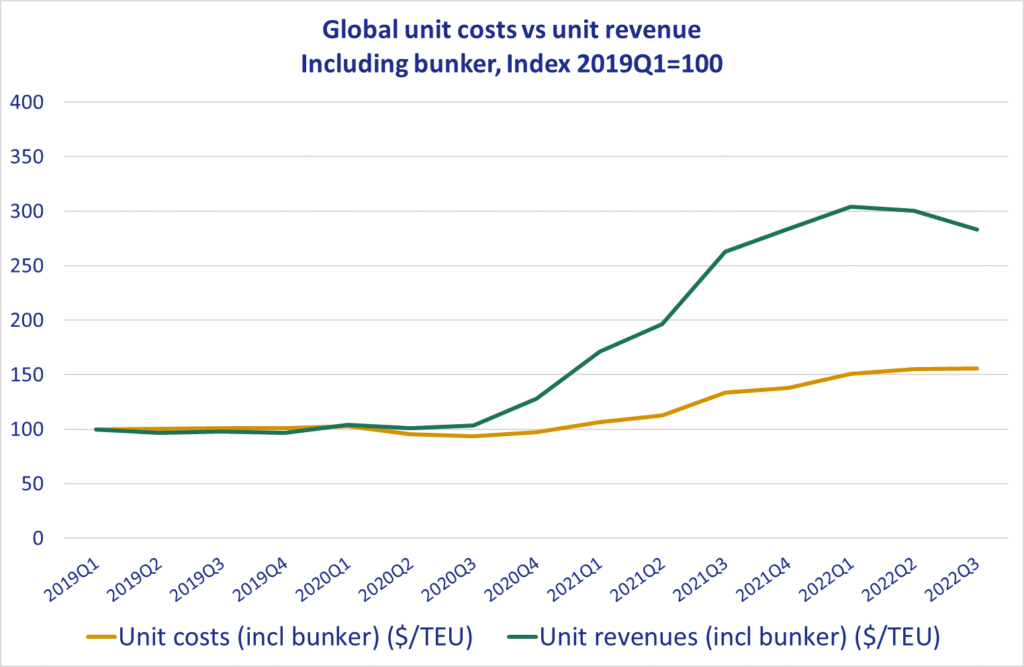

- Despite falling for a second quarter, carriers’ unit revenues (earnings per container moved) were still 2.8 times higher than pre-Covid rates whereas unit operating costs have only risen by a factor of 1.5 over the same period. Cost pressures have largely been higher charter rates and a slow rise in fuel costs that has since receded. Container shipping lines remain highly profitable despite a falling market.

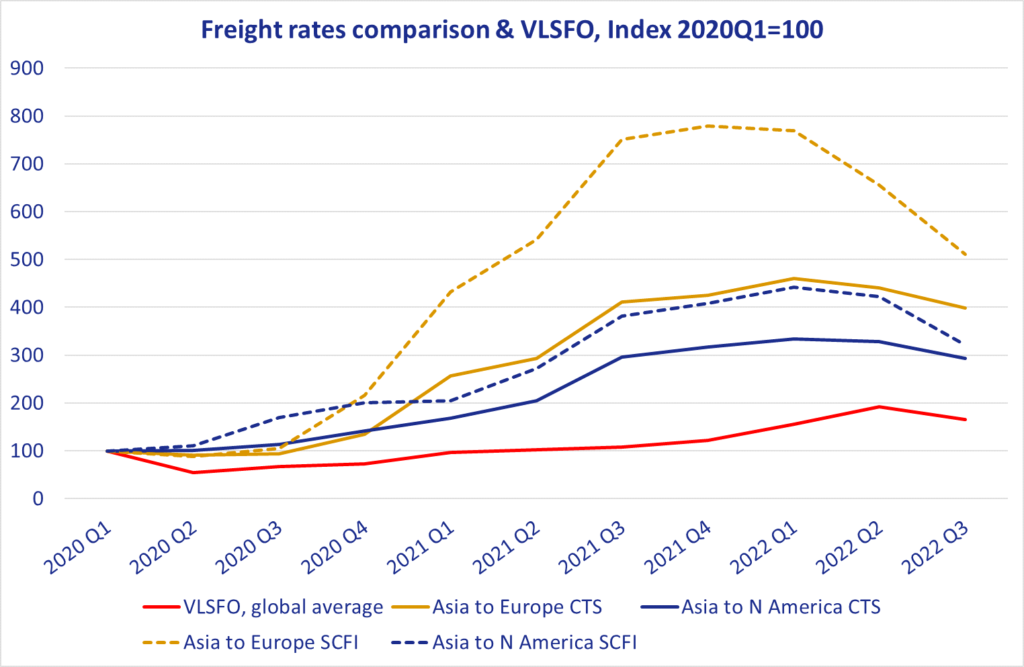

- Spot rates fell by a fifth during the period, leaving many shippers ‘burnt’ by their decisions to commit to long-term contacts earlier in the year and questioning the many sources in the industry who confidently predicted that disruptive congestion and capacity shortages would continue through 2022 and beyond.

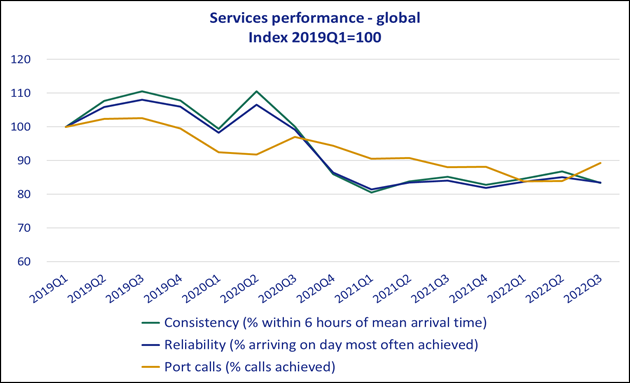

- Adding to shippers’ frustrations, service levels remained at historic lows, with the predictability of arrivals still at only 85 per cent, meaning 1 in 6 sailings arrived later than normally expected.

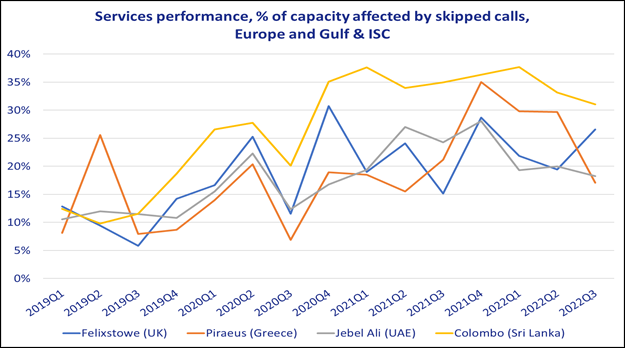

- The modest improvements recorded in the number of scheduled port calls made, at 90 per cent, is a welcome positive that can be partly attributed to the rising number of sailings that were ‘blanked’ during the period and didn’t sail at all, so easing the pressure on intermediate ports. Many of these saw an improvement in the proportion of expected capacity actually calling at the port s monitored but the proportion of lost capacity is still at historically high levels.

Mike Garratt, Chair of MDS Transmodal said:

“In quarter 3 2022 we saw the mean rates charged by the major lines continuing to suppress the proportion of container traffic they carried while the role played by new entrants was small. During quarter 3 we have seen several of these recent entrants leave the market as spot rates have fallen sharply, while leaving mean rates paid much higher. With a combination of stagnant demand and few ships now being delayed by port congestion, one would expect competition for shippers’ business to lead to a recovery of the share of the overall cargo market carried by container.”

James Hookham, Director of Global Shippers Council, commented:

“The quarter saw the downturn in volumes recorded at the end of Quarter 2 turn into a sustained decline – conditions that have not been seen in the container shipping market for over ten years. Many shippers are experiencing the behaviour of the market under such conditions for the first time.

“Blanked sailings, slow steaming and other capacity management measures will add to the catalogue of frustrations accumulated over the previous 30 months of record high rates and poor levels of service”.

“The widening gap between spot rates and contact prices agreed six months prior to these data will anger shippers further and demands a flexible and immediate response by carriers if their dream of securing a majority of their business on contract ted terms is to be achieved.”

“The big question going into 2023 will be how much of their diminished volumes will shippers commit to renegotiated contracts and how much will they reserve for the spot market, which is expected to fall to below pre-Covid levels in the next few weeks?”

“Countering this trend will be efforts to manage capacity through ‘blanked sailings’ However, the extent to which spot rates are being supported by this permitted co-ordination between consortia partners is playing out just as competition authorities in Europe and North America are evaluating existing anti-trust measures and considering possible options for the future”.

Notes to Editors

- Mike Garratt, Chairman of MDS Transmodal, is available for interview. Please contact +44 (0) 1244 348301

- James Hookham, Director of GSF, is available for interview. Please contact: +44 (0)7818 450440; secretariat@globalshippersforum.com

- Media Contact: The Container Shipping Market Quarterly Review for Quarter 2 2022 is available in PDF format on request from Maria Udy, Portcare International. maria@portcare.com +44 (0) 7979 868539.

- The Container Shipping Market Quarterly Review is produced every three months and reports, interprets and comments on trends and developments in the container shipping market as experienced and understood by shippers – the importers and exporting businesses that own the cargo carried on container ships. Shippers are the customers of the container shipping industry.

- The Quarterly Review collates and reports outputs from MDS Transmodal’s established and respected Container Business Model and other tools that are relied upon by governments and international agencies around the world. Working with GSF, MDST has generated eight new indicators showing how the market is performing in terms that are relevant and applicable to shippers as users and customers of these services.

- MDS Transmodal (MDST, www.mdst.co.uk) is a UK firm of transport economists which specialises in maritime and all other modes of freight transport. MDST works with senior management in the public and private sectors to provide strategic advice based on quantitative analysis, modelling and sectoral expertise.

- Global Shippers Forum (www.globalshippersforum.com) is the global business organisation speaking up for exporters and importers as cargo owners in international supply chains and trade procedures. Its members are national and regional shippers’ associations representing hundreds of manufacturing, wholesaling, and retailing businesses in over 20 countries across five continents. GSF works for safe, competitively efficient, and environmentally sustainable global trade and logistics.