The 2013 Young International Freight Forwarder of the Year Award has been presented to German forwarder Janna Van Burgeler at a ceremony during the FIATA Congress in Singapore.

Earlier this year, entrants from all over the world submitted papers focusing on key import and export commodity/cargo projects. From these the Steering Committee selected a shortlist of four regional finalists. These four young professionals were then invited to attend the 2013 FIATA World Congress this week in Singapore to make a presentation regarding their dissertation topic to the Young International Freight Forwarder of the Year (YIFFY) Steering Group.

The four regional finalists who represent the future of the international freight forwarding industry included –

Africa/Middle East: Mr Mohamed Samy, Egypt

Americas: Mr Kaloyan Petrov, Canada

Asia/Pacific: Mr Prabhot Singh, India

Europe: Ms Janna Van Burgeler, Germany

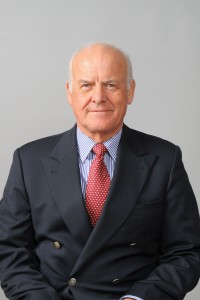

Following the formidable task of choosing an overall winner, the Steering Committee announced, during the World Congress opening ceremony on 16th October, that the overall YIFFY Winner for 2013 was Ms Janna Van Burgeler from Germany. She was presented with her award by TT Club’s Regional Director for Europe, Andrew Kemp.

“As sponsors of this prestigious award the TT Club is honoured to be part of the selection process, and I personally am grateful to have received the finalists’ presentations. I am pleased to say all four came with flying colours and it was a difficult decision to pick an overall winner. However, Janna prevailed and deservedly takes this year’s award,” reported Kemp.

The award is presented in recognition of forwarding excellence and was established by FIATA with the support of TT Club to encourage the development of quality training in the industry and to reward young talent with additional valuable training opportunities. The TT Club has been a sponsor of the award since its inception and is firmly committed to the importance of individual training and development within the global freight forwarding community.

The Award Steering Committee strives to make the challenge appealing to a greater number of candidates and allow them to call on their day-to-day experiences when working for a range of organisations, whether it’s a small customs agent or a multi-national operator.

Speaking at the award ceremony, TT Club’s Kemp, said, “We are proud to have been able to continue our sponsorship of this unique award, now in its fifteenth year. Once again, the competition proved to be successful in terms of attracting candidates from across the globe. The quality of the dissertations and presentations were of the usual exceptional standard and it was clear that a lot of research, planning and hard work had gone into their preparation.”

ENDS

Note to Editors:

The TT Club is the international transport and logistics industry’s leading provider of insurance and related risk management services. Established in 1968, the Club’s membership comprises ship operators, ports and terminals, road, rail and airfreight operators, logistics companies and container lessors. As a mutual insurer, the Club exists to provide its policyholders with benefits, which include specialist underwriting expertise, a world-wide office network providing claims management services, and first class risk management and loss prevention advice.