18 December 2014

The Shipowners’ Club is a mutual provider of P&I insurance that has throughout its 160 year history been dedicated to serving owners of small and specialist ships. These vessels, active in a range of different operations, are at the lower end of the size spectrum and, in keeping with the trend seen across vessel design as a whole, are also getting larger in order to cope with the demands of their individual markets.

In a recent blog, the Club’s Underwriting Director, Ian Edwards has outlined more detail of the trend and explains how the Club has responded to its Members’ needs.

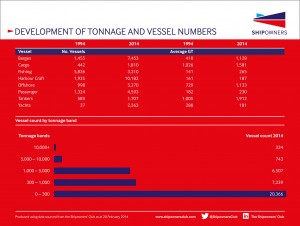

Some 20 years ago 12,655 of these vessels were covered by the Club and had an average size of 297GT. In the intervening period numbers have increased nearly threefold and the average size of an entered vessel has more than doubled to 672GT.

“It is definitely the case that larger vessels are more likely to generate larger claims,” comments Edwards in his blog, “But as a result of the Club’s long and in-depth experience of insuring these specialist vessels, we also believe that larger vessels, as long as they are well run and operate a well defined regional trading pattern, represent as good a risk as some smaller vessels. We are more than happy to consider regionally trading vessels up to 20,000GT for entry with the Club.”

An analysis of the various sectors in which the Club’s vessels operate puts meat on the bones of the growth trend. Coastal tankers have increased in size by 90%; those in dry cargo trades by 50%, while offshore vessels have similarly grown by 50% and dumb barges by 269%.

The superyacht fleet is of particular interest, as it is one of the sectors which bucks the trend. Shipowners’ was the first P&I Club to offer full cover to the owners of such vessels. Twenty years ago there were just 37 yachts entered; now the number has now grown to over 2,200 (as at 20 February 2014). In 1994 it was only the largest and widest trading yachts that required the most comprehensive P&I cover available but over time smaller yachts switched from the restricted cover provided by the commercial markets. As a consequence, while large superyachts have grown in size (the largest entered in the Club is some 13,000GT), the average size of yachts covered by Shipowners’ has actually reduced.

Regional trade has generally been a feature of the operation of smaller vessels but there is now a tendency for vessels to be larger and to operate further afield. This has increasingly become the case with specialist vessels and, in particular those operating in the offshore sector. “To best serve our Members with the most appropriate cover, it is vital for the Club to monitor and analyse these trends and to understand the changes that are taking place in Members’ fleets,” concludes Edwards. “Our largest offshore vessels have regularly been in excess of 10,000GT for many years, likewise the larger dredgers. We will always try to provide the cover that our Members need for the vessels they acquire if their trading fits with the overall profile of the Club’s varied sectors.”

Link to blog: http://www.shipownersclub.com/ian-edwards-meeting-our-members-changing-needs

ENDS

Notes for editors

The Shipowners’ Club is

a mutual marine liability insurer, providing Protection & Indemnity insurance to small and specialist vessels since 1855. The Club is a member of the International Group of P&I Clubs and works with more than 600 broking companies globally to insure over 33,000 vessels across a range of operating sectors and geographical areas.